Financial Markets assessment

Final Grade: 94%

The foreign exchange market is the largest market in the world with an average trading volume of $5 trillion a day. The EUR/USD is the most popularly traded currency pair as both currencies represent the two largest and most influential economies in the world: the U.S. and the European Union. Many factors can influence the value of the Euro and the U.S. dollar in relation to each other, as well as other currencies. The most important economic indicator is the interest rate. All eyes are now on the central banks, with the European Central Bank (ECB) meeting this Thursday, September 12, and the U.S. Federal Reserve on September 18. Eurozone interest rates have been held near zero (Figure 1) for years to stimulate growth, the bank has hinted that they will keep them low for longer. Table 1 shows that negative interest rates was first introduced in June 2014.

Figure 1 Euro area interest rate from September 2016 – September 2019. The ECB kept rates on hold in July with the main refinancing rate remaining at 0 and the deposit rate at -0.4%.

Figure 1 Euro area interest rate from September 2016 – September 2019. The ECB kept rates on hold in July with the main refinancing rate remaining at 0 and the deposit rate at -0.4%.

| Date | Deposit facility | Main refinancing operations | Marginal lending facility | ||

| Fixed rate tenders Fixed rate |

Variable rate tenders Minimum bid rate |

||||

| With effect from | |||||

| 2019 | 18 Sep. | −0.50 | 0.00 | – | 0.25 |

| 2016 | 16 Mar. | −0.40 | 0.00 | – | 0.25 |

| 2015 | 9 Dec. | −0.30 | 0.05 | – | 0.30 |

| 2014 | 10 Sep. | −0.20 | 0.05 | – | 0.30 |

| 11 Jun. | −0.10 | 0.15 | – | 0.40 | |

| 2013 | 13 Nov. | 0.00 | 0.25 | – | 0.75 |

| 8 May. | 0.00 | 0.50 | – | 1.00 | |

| 2012 | 11 Jul. | 0.00 | 0.75 | – | 1.50 |

| 2011 | 14 Dec. | 0.25 | 1.00 | – | 1.75 |

| 9 Nov. | 0.50 | 1.25 | – | 2.00 | |

| 13 Jul. | 0.75 | 1.50 | – | 2.25 | |

| 13 Apr. | 0.50 | 1.25 | – | 2.00 | |

Table 1 Key ECB interest rates from April 2011 – September 14, 2019 (European Central Bank 2019).

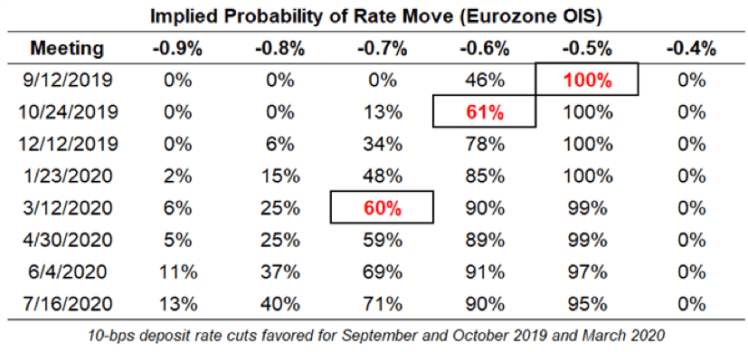

Table 2 ECB interest rate expectations (September 6, 2019) by DailyFX.

Table 2 ECB interest rate expectations (September 6, 2019) by DailyFX.

Table 2 (Daily FX 2019) suggests that there is a 100% chance of a 10 basis point rate cut this Thursday, which will push the deposit rate to -0.5%. In addition to interest rates, other factors that also have considerable influence on the EUR/USD are: GDP, inflation, unemployment rate, current account deficits, balance of trade, speculation, government stability and the political environment. As with many things in macroeconomics, it’s wise to know that many of these factors are related and can feed off each other. For example, higher rate of inflation than expected can lead to central bank intervention, such as raising rates and buying or selling the domestic currency. This could trigger an increase in government debt which becomes less attractive to foreign investors. Fundamental factors important to EUR/USD analysis also include international news. Currently, elections, political uncertainties, recession fears, uncertainty over Brexit and the ongoing global trade war are all contributing to a global slowdown and have had consequences for the pair.

Figure 2 EUR/USD chart taken from TradingView at 15:00 (UTC+10) September 9.

Figure 2 EUR/USD chart taken from TradingView at 15:00 (UTC+10) September 9.

The Euro currently remains extremely vulnerable. Frustratingly weak macroeconomic reports, as well as Germany on the cusp of a technical recession, have only added fuel to the fire. On September 3, the EUR/USD declined to multi-year lows of 1.0926, as traders priced in a rate cut by the ECB at its next meeting on September 12. The price recovered shortly after and ‘closed the weekly candlestick above 1.10 handle with a 0.4% gain’ (Mahmoud Alkudsi 2019). As of September 9, 15:00 (UTC+10), the rate of EUR/USD is 1.1028 (Figure 2). According to the chart, the exchange rate has been in a downtrend for over a year now. Given the norm that the established trend is more likely to extend than reverse, the short-term downtrend remains intact and will probably go even lower. If the ECB lowers its key rate this week and loosens the monetary policy, that of course should drive the Euro down. With Germany heading into a recession, it makes even more sense that the Euro would struggle.

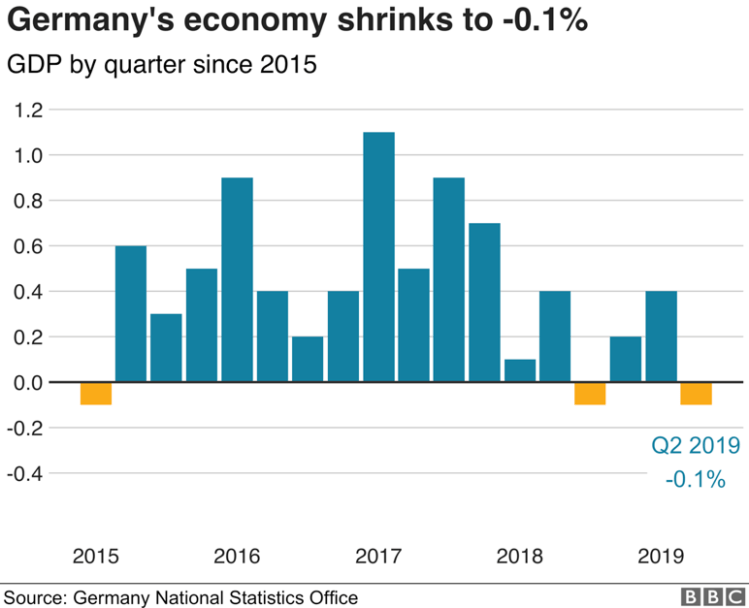

Figure 3 Germany’s GDP contracted 0.1% in the second quarter of this year (BBC News 2019).

Figure 3 Germany’s GDP contracted 0.1% in the second quarter of this year (BBC News 2019).

Figure 4 Germany exports from June 2018 – July 2019. Exports from Germany fell 8 percent year-on-year to EUR 106.1 billion in June 2019 (CEIC Data 2019).

Figure 4 Germany exports from June 2018 – July 2019. Exports from Germany fell 8 percent year-on-year to EUR 106.1 billion in June 2019 (CEIC Data 2019).

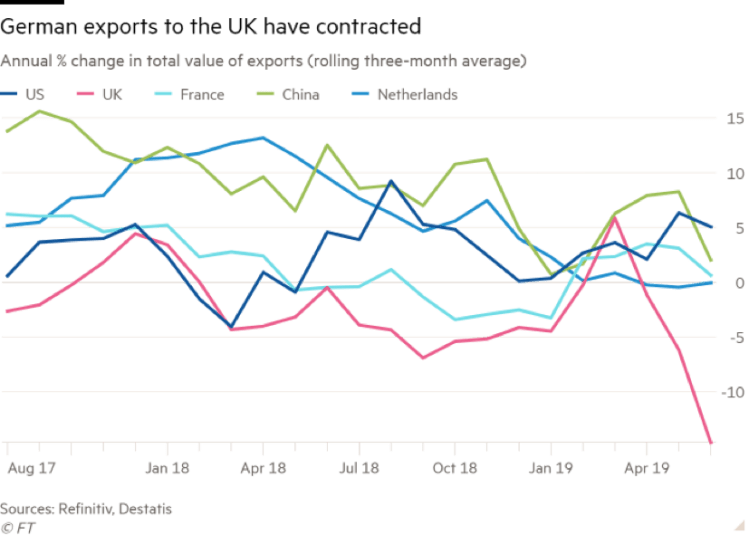

Figure 5 Exports to Britain dropped 21% quarter on quarter in the three months to June (Financial Times 2019).

Figure 5 Exports to Britain dropped 21% quarter on quarter in the three months to June (Financial Times 2019).

The most important economic data comes from Germany, the largest economy in the eurozone. Key data usually comprises GDP, inflation, industrial output, and unemployment. Figure 3 shows that German GDP fell into the negative region (0.1%) in the second quarter. The country will officially be in a recession if there are two back-to-back quarters of negative growth. The ECB president, Mario Draghi, himself said that the outlook in the eurozone economy was becoming progressively worse for sectors such as manufacturing. German industrial output abruptly fell in June (Figures 4 & 5), their export-oriented economy is suffering from the ongoing global trade war and political uncertainties. The hit to GDP came from declining industrial and automobile exports, which makes sense as China is a major export market for luxury cars.

Figure 6 EUR/USD daily price chart (June 12 – Sep 9, 2019) by Mahmoud Alkudsi.

Figure 6 EUR/USD daily price chart (June 12 – Sep 9, 2019) by Mahmoud Alkudsi.

From a technical perspective, nothing seems to have changed much for the EUR/USD pair and the 1.1000 mark might continue to protect the instant downside. Breaching the 1.10 support will indicate that the recent correction has already run out of the steam and is preparing for the continuation of the established downtrend. Breach of the multi-year swing lows of 1.0926 (Figure 6) will resume larger downtrend from 1.2555 (2018 high). A break below the 1.0900 round figure may provide confirmation of more decline to the 1.0830-35 support area (a tough spot where a market gap occurred during the April 2017 decline), followed by 1.0750 potentially. The market will probably eventually go down but in the short term there’s likely to be lot of noise and even a slight upward trend in the pair. But in general, given that the fundamental background for the Euro remains negative, it’s likely that the pair will continuing falling in September and a longer-term downtrend will follow.

Reference List

Action Forex 2019, EUR/USD Mid-Day Outlook, Action Forex, viewed 9 September 2019, <https://www.actionforex.com/technical-outlook/eurusd-outlook/231696-eur-usd-daily-outlook-685/>.

Alkudsi, M 2019, Euro Outlook Ahead of ECB: EUR/USD, EUR/JPY Price What Now After The U-Turn?, MenaFN, viewed 9 September 2019, <https://menafn.com/1098985602/Euro-Outlook-Ahead-of-ECB-EURUSD-EURJPY-Price-What-Now-After-The-UTurn>.

BBC News 2019, ‘German economy slips back into negative growth’, BBC News, viewed 9 September 2019, <https://www.bbc.com/news/business-49342012>.

CEIC Data 2019, Germany Total Exports Growth, CEIC Data, viewed 11 September 2019, <https://www.ceicdata.com/en/indicator/germany/total-exports-growth>.

European Central Bank 2019, Key ECB interest rates, European Central Bank, viewed 14 September 2019, <https://www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html>.

Financial Times 2019, ‘Brexit weighs on Germany’s export-dependent manufacturers’, Financial Times, viewed 9 September 2019, <https://www.ft.com/content/20c144ec-c7ee-11e9-a1f4-3669401ba76f>.

Hyerczyk, J 2019, EUR/USD Mid-Session Technical Analysis for September 6, 2019, FX Empire, viewed 9 September 2019, <https://www.fxempire.com/forecasts/article/eur-usd-mid-session-technical-analysis-for-september-6-2019-598611>.

Menghani, H 2019, EUR/USD forecast: Going nowhere in a hurry ahead of Thursday’s ECB decision, FXStreet, viewed 9 September 2019, <https://www.fxstreet.com/analysis/eur-usd-forecast-going-nowhere-in-a-hurry-ahead-of-thursdays-ecb-decision-201909090529>.

Monfort, J 2019, EUR/USD Week Ahead Forecast: Downtrend Remains Intact, Key ECB Decision to Provide Volatility, Pound Sterling Live, viewed 9 September 2019, <https://www.poundsterlinglive.com/eurusd/12007-eur-usd-week-ahead-forecast-downtrend-remains-intact-key-ecb-decision-to-provide-volatility>.

Trading Economics 2019, Euro Area Interest Rate, Trading Economics, viewed 9 September 2019, <https://tradingeconomics.com/euro-area/interest-rate>.

TradingView 2019, EURUSD Forex Chart, TradingView, viewed 9 September 2019, <https://www.tradingview.com/symbols/EURUSD/>.

Vecchio, C 2019, Weekly Euro Forecast: Rate Cut Due at September ECB Meeting as Growth Stalls, DailyFX, viewed 11 September 2019, <https://www.dailyfx.com/forex/fundamental/forecast/weekly/eur/2019/09/10/weekly-euro-rate-forecast-interest-rate-cut-due-at-september-ecb-meeting-as-growth-stalls-germany-recession.html>.